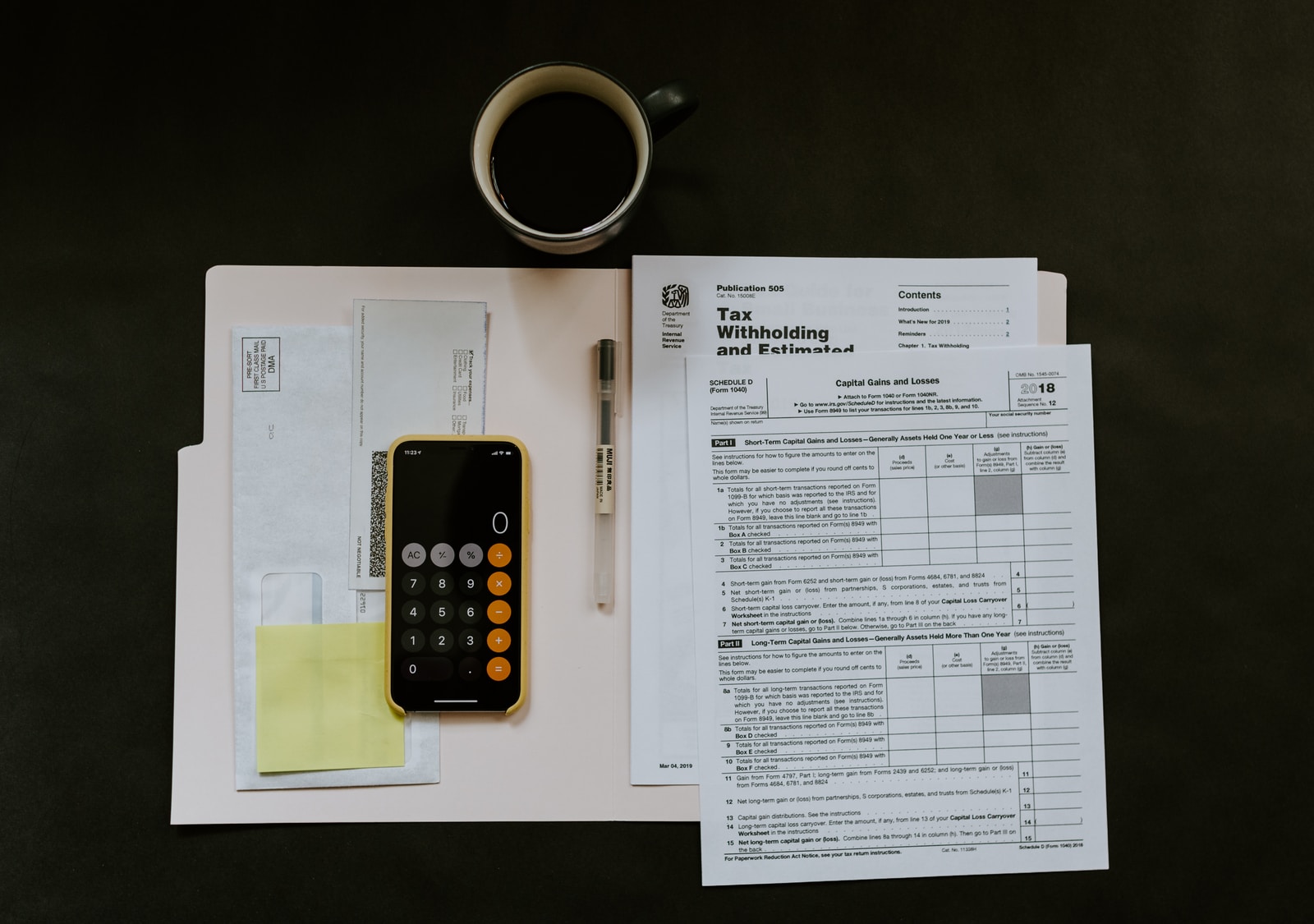

Accounting and bookkeeping is a major aspect of maintaining legal balance for a business. Any business operating in the United States will need to file an income tax return each year and it’s imperative to keep the books as clean as possible. Failure to properly report annual income from your business could result in legal consequences.

Legal Consequences from Bad Accounting

The consequences of having poor accounting and bookkeeping practices can be serious for businesses. Not filing taxes, or filing them incorrectly, can lead to fines, penalties, and even jail time. In some cases, businesses may have to pay back taxes, interest, and additional penalties.

It’s also important to keep your books in good order to avoid any legal issues. If you’re ever audited by the IRS, they will review your books to make sure everything is in order. If there are any discrepancies or mistakes, you could be subject to additional fines and penalties.

Overall, it’s important to have a good understanding of accounting and bookkeeping in order to stay compliant with the law and avoid any costly consequences. For this reason, it’s important to find an accountant that you can trust to help you stay in compliance with the law. Many accountants offer a variety of services, so be sure to ask about their experience with small businesses and what specific services they can provide.

Common Accounting Services

Some of the most common services offered by accountants include:

– Preparing and filing income tax returns

– Providing bookkeeping services

– Offering advice on how to reduce your taxes

– Advising on how to set up a bookkeeping system for your business

– Helping you understand your business’ financial statements

– Offering guidance on record keeping requirements

– Helping you establish a credit rating for your business

– Assisting with audits

As you can see, there are many services an accountant can offer your business.

Working With An Accountant

If you decide to work with an accountant, be sure to provide them with all the information they need to do their job properly. This includes financial statements, tax returns, and any other documentation related to your business. Keeping your accountant up-to-date on changes in your business (e.g. changes in ownership, new products or services, etc.) will help ensure that they can provide you with accurate advice.

Just like working with an attorney, the more you can share with your accountant, the better.

How to Find An Accountant or Bookkeeping Company

Accounting and tax firms are a dime a dozen. You can find branches of major companies like H&R Block on every corner of most large cities. Since you want a company to be involved with your business, it’s recommended to find an account from an independent firm rather than a chain.

Find An Accountant Through Referrals

Be sure to ask friends and family for referrals. Past experiences from a qualified individual will be your best bet to finding a bookkeeping company you can trust. You can also check with the National Association of Accountants or the American Institute of Certified Public Accountants for a list of qualified professionals in your area.

Find An Accountant Through Online Reviews

Online reviews can also be a helpful way to find an accountant. Sites like Yelp and Google Maps allow customers to post reviews of local businesses. Go to your favorite search engine and look up “bookkeeper near me” to see the top-rated results in your area. Checking out the reviews of an accountant can help you get a sense of their experience and what services they offer.

The Bottom Line

Use these tips to keep your bookkeeping and accounting in order. You’ll never want to be audited by the IRS, but if it happens, be prepared.